In agriculture, its common for new products to go through field trials. Trials are lengthy and are often run at the cost of the vendor who is looking to build a proof of concept for their product.

Pouring Fuel on the Fire — on Product Market Fit

Jon Schmitz | Agrilyst

Reprinted with permission from Agrilyst:

It’s no secret — finding product market fit is TOUGH for startups. You start by identifying a need, gathering feedback, testing, and iterating until you’ve commercialized your product to a point of wide adoption.

We recently reached that point of inflection at Agrilyst and I want to share a little bit about how we accelerated sales and the process of scaling that Mount Everest-esque growth curve.

As background, I oversee Sales and Partnerships here at Agrilyst and have been with the team since February 2017. During my first seven months, I built out our mid-market sales process, and then I hired and trained our mid-market sales team. From there, I moved into building our enterprise sales process and team. I now also oversee our business development partnerships.

Laying the groundwork

One of the biggest impediments to rapid growth is a long sales cycle. Why? If a customer is making a decision on the spot, you can build a massive funnel and push people through it quickly. Sales becomes a numbers game. How do you increase the number of leads at the top of the funnel? How do you increase efficiency through the funnel?

A long sales cycle, on the other hand, requires more resources over a longer period of time to close. If a deal falls through, it hurts the funnel more. So we focus on quality of leads and efficiency through the funnel more with a longer sales cycle process.

In agriculture, it’s common for new products to go through field trials. Trials are lengthy and are often run at the cost of the vendor who is looking to build a proof of concept for their product.

The reason field trials are so popular is to ensure products work. For growers, if a product doesn’t work, it can devastate their business. So the key for us was to build a product that works and solves a huge problem for growers in order to bypass the field trial process.

We started by selling our software to smaller, mid-market customers.

Our mid-market customers are awesome. They have an eye on scale and growth of their own operations, but have to first build a strong customer base (similar process, right?). The level of professionalism and thoroughness we find at these facilities that are run over tens of thousands of square feet easily match those of multi-acre facilities. This made gathering feedback and iterating extremely easy and allowed us to make the best product as quickly as possible.

Process is critical here. I track a lot of data. I started tracking interactions to close (if you’re wondering, it takes 7 interactions to close our mid-market growers). Then I added types of interactions (# of phone calls, emails, texts, demos, in-person visits). I watch the conversion rates through the funnel (we move about 13% of our customers through the top of the funnel and about 50% of customers sign up for Agrilyst after a demo). This data is important. I knew in order to scale a sales team that could sell our product, we had to know exactly what it would take to close a sale every single time. A process is only as good as how repeatable it is.

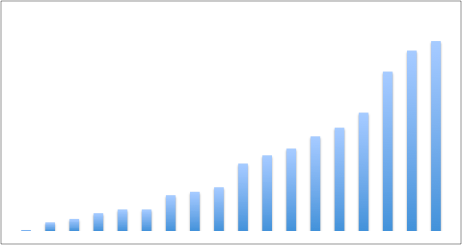

So what does that process amount to? We increased revenue 32x in our first 6 months and added 9x in the next 12 months. Our growth started hitting it’s stride, growing at 23% month over month.

Exponential monthly sales growth

Entering Enterprise

Our mission as a company is to expand the indoor agriculture industry by helping growers become more profitable. Part of our move to enterprise sales was driven by our mid-market customers expanding and needing more from us. They run their whole operation on our software, so when they expand from under an acre to 10+ acres, that means more than just farm management software. It means integrations with accounting and payroll systems, more advanced analytics, and a big focus on employee management.

So we started building. And it wasn’t just our expanding mid-market customers who wanted to expand with us, but other large enterprise operations. Why?

Working with our mid-market customers, we had:

- Nailed the automation of labor scheduling and task tracking. Adding to that, we incorporated crop, operational, and phenotypic metric tracking directly into the labor workflow.

- Integrated climatic and other types of farm data collected outside of the platform into the platform to make meaningful decisions.

- A kick-ass Customer Success team that hit their stride, receiving above industry average NPS scores.

- Rolled out food safety logging fully compliant with the new regulations, a huge pain point for growers.

This resonated with large growers. There was nothing in the market quite like us and they were excited and ready to begin discussing adoption into their facilities. Bingo.

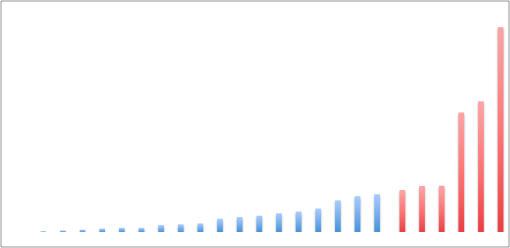

Since those meetings, it’s been a full court press into enterprise. To give you an idea of what that inflection point looks like, the graph below shows our revenue growth since we started selling in 2016. The blue shows the same graph as above, the red is our growth after we started selling to the enterprise. We’re now growing at 41% month over month.

Revenue growth since expanding into enterprise.

We are so proud to work with some of the greatest growers in the world and we’re excited to keep scaling up.

What’s Next?

So the obvious question is: what’s next? Where do we go from here?

We’re making a huge, archaic industry that is clunky and inefficient for the grower more profitable for growers. Our goal is to own the entire supply chain, giving growers back margin wherever we can. We want to light the industry on fire and accelerate innovation to meet needs of society 30 years from now and beyond. That means continued growth in product offerings, geographic reach, and more from us.

The content & opinions in this article are the author’s and do not necessarily represent the views of AgriTechTomorrow

Comments (0)

This post does not have any comments. Be the first to leave a comment below.

Featured Product